SELF Tokenomics

Token Overview

- Token Symbol: $SELF

- Total Supply: 500,000,000 (500 Million)

- Token Standard: ERC-20

- TGE Supply: 105,500,000 (21.1% of total supply)

- Public Sale Price: $0.06

- Listing Price: $TBC

- TGE Market Cap: $6,330,000

- Fully Diluted Valuation: $30,000,000

Token Distribution

| Category | Allocation | Tokens | TGE Release | Vesting Schedule |

|---|---|---|---|---|

| Pre-Seed | 10% | 50,000,000 | 50% (25M) | 10 months linear |

| Seed | 2% | 10,000,000 | 25% (2.5M) | 12 months linear |

| Private | 2% | 10,000,000 | 25% (2.5M) | 3 month cliff, 15 months linear |

| Public | 1% | 5,000,000 | 20% (1M) | 1 month cliff, 15 months linear |

| Partners | 4% | 20,000,000 | 10% (2M) | 3 month cliff, 15 months linear |

| Team & Advisors | 10% | 50,000,000 | 0% | 3 month cliff, 36 months linear |

| Liquidity | 10% | 50,000,000 | 100% (50M) | For DEX/CEX liquidity |

| User Adoption | 15% | 75,000,000 | 10% (7.5M) | 48 months linear |

| Developer Incentives | 15% | 75,000,000 | 10% (7.5M) | 48 months linear |

| Ecosystem | 15% | 75,000,000 | 10% (7.5M) | 48 months linear |

| Staking | 16% | 80,000,000 | 0% | 36 months linear |

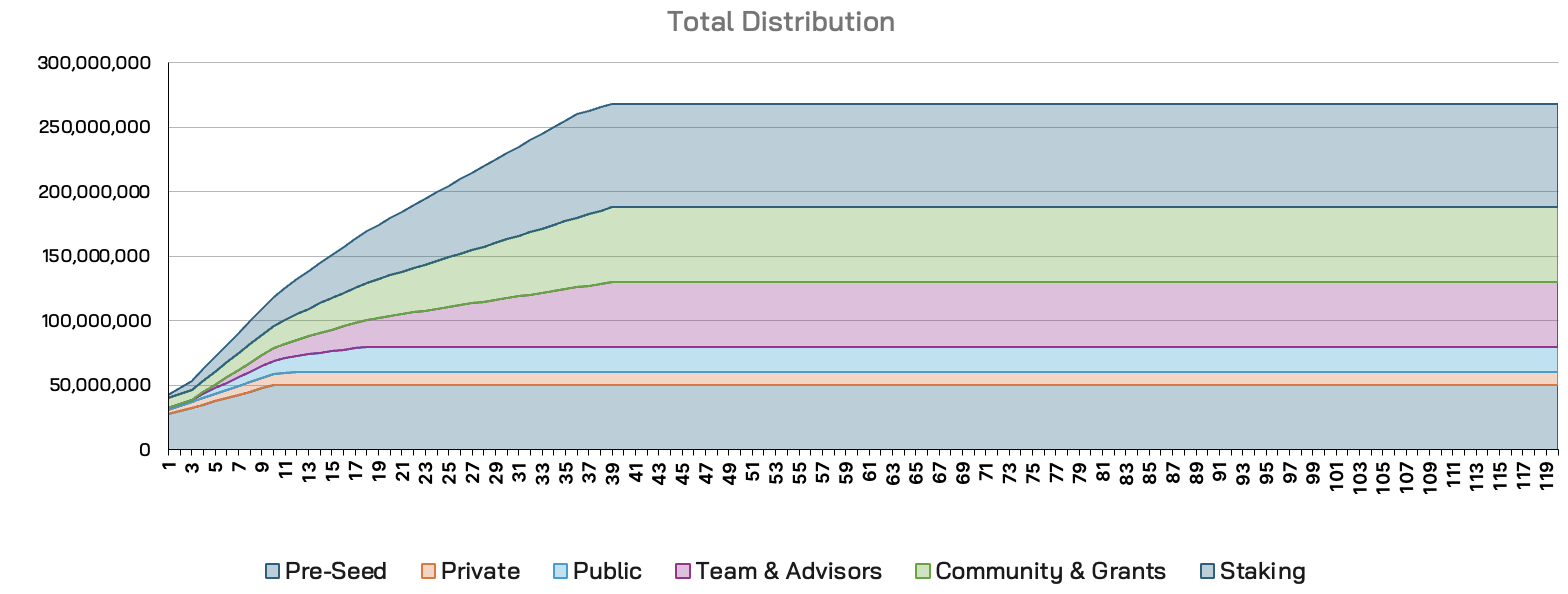

Token Distribution Visualization

The chart above shows the cumulative token distribution over 48 months, illustrating how tokens are gradually released according to their vesting schedules. Key observations:

- Immediate liquidity: 50M tokens (10%) available at TGE for DEX/CEX liquidity

- Controlled release: Team & Advisor tokens have the longest vesting (36 months) with a 3-month cliff

- Community focus: 61% of tokens allocated to ecosystem growth (User Adoption, Developer Incentives, Ecosystem, Staking)

- Investor protection: Gradual vesting prevents large sell pressure

Fundraising Details

| Round | Price | Raise Amount | Valuation |

|---|---|---|---|

| Pre-Seed | $0.03 | $1,500,000 | $15M FDV |

| Seed | $0.04 | $400,000 | $20M FDV |

| Private | $0.05 | $500,000 | $25M FDV |

| Public | $0.06 | $300,000 | $30M FDV |

| Total Raise | - | $2,700,000 | - |

Staking Program

Regular Staking (All Users)

| Lock Period | Base APR |

|---|---|

| No lockup | 8% |

| 3 months | 12% |

| 6 months | 16% |

| 9 months | 20% |

| 12 months | 22% |

| 18 months | 25% |

| 24 months | 30% |

Note: Longer lockup periods qualify for additional benefits such as discounts, whitelists, and airdrops (TBC).

Bonus Staking Program (Pre-Seed/Seed Investors Only)

Available only for investors who lock tokens before TGE:

| Lock Period | Extra Tokens | APR |

|---|---|---|

| 1 month | +10% | 120% |

| 3 months | +20% | 80% |

| 6 months | +30% | 60% |

Example: Locking 1,000 tokens for 3 months gives you 1,200 tokens total

Token Utility

1. Subscription Payments

- Purchase SELF subscriptions with token discounts (TBC)

- Dynamic USD-based pricing with token payments

- Tier access based on staked amount

2. Staking Benefits

- Earn APR on staked tokens

- Access higher service tiers (TBC)

- Receive partner airdrops (TBC)

3. Ecosystem Currency

- Primary currency within SELF ecosystem

- Payment for services and features

- Cross-chain transaction fees (on SELF Chain)

- Trading within decentralized applications

4. Governance (TBC)

- Vote on protocol upgrades

- Participate in DAO decisions

- Influence feature development

- Cross-Constellation governance (Multiverse tier)

Deflationary Mechanisms

1. Subscription Burns

- % of subscription payments are burned (TBC)

- Reduces circulating supply over time

2. Buyback & Burn

Revenue from SELF services is used for buybacks:

- 40% of buyback tokens are burned (TBC)

- 40% distributed to stakers (TBC)

- 20% for premium user rebates (TBC)

3. Transaction Burns

- Small percentage of SELF Chain transactions burned (TBC)

- Increases scarcity as network usage grows

Supply Schedule

Year 1 Circulating Supply

- TGE: 105.5M tokens (21.1%)

- Month 6: ~163M tokens (32.6%)

- Month 12: ~246M tokens (49.2%)

Long-term Supply

- Year 2: ~351M tokens (70.3%)

- Year 3: ~449M tokens (89.9%)

- Year 4: 500M tokens (100%) - Full circulation

Investor Protection

1. Vesting Schedules

- Team tokens locked for 3 years

- Investor tokens vest over 10-15 months

- Limited sell pressure at launch

2. Liquidity Provisions

- 10% supply dedicated to liquidity

- Deep liquidity pools on major DEXs

- Market making partnerships

3. Utility First

- Real utility from day one

- Staking rewards immediately available

- Subscription discounts active at launch

Note: Tokenomics are subject to change based on market conditions and regulatory requirements. Always refer to official announcements for the most current information.